In the intricate realm of business operations, payroll administration stands as a cornerstone function, ensuring that employees are compensated accurately and on time. Yet, navigating the complexities of payroll processing requires a deep understanding of regulations, meticulous attention to detail, and adept handling of various software tools.

As such, payroll administration training becomes not just beneficial but essential for professionals tasked with managing this critical aspect of organizational management.

In this article, we delve into the importance of payroll administration training and how it lays the groundwork for building a solid foundation in this vital field.

Understanding Payroll Fundamentals

At its core, payroll administration involves the calculation, processing, and distribution of employee compensation, including salaries, wages, bonuses, and deductions. Payroll professionals must comprehend the fundamental principles governing payroll, such as tax regulations, wage laws, benefits administration, and compliance requirements.

Pitman training programs provide participants with a comprehensive overview of these essentials, ensuring they possess the knowledge needed to navigate the intricacies of payroll administration effectively.

Furthermore, payroll administration encompasses tasks like managing payroll taxes, handling employee benefits, and ensuring accurate record-keeping. Thus, payroll training programs not only cover the fundamental principles but also delve into advanced topics to equip participants with a well-rounded understanding of payroll administration.

Navigating Legal and Regulatory Frameworks

One of the most critical aspects of payroll administration is compliance with legal and regulatory frameworks. From federal and state tax laws to labor regulations and reporting requirements, payroll professionals must stay abreast of a myriad of rules and regulations to ensure compliance and avoid costly penalties.

Training programs equip participants with a deep understanding of these legal frameworks, providing guidance on how to interpret and apply regulations correctly in their payroll processes.

Moreover, staying updated with changes in tax laws and labor regulations is crucial to ensuring ongoing compliance and mitigating potential risks for the organization. By participating in training programs, payroll professionals not only gain knowledge of existing legal frameworks but also learn how to adapt to evolving regulations and implement best practices to maintain compliance.

Mastering Payroll Software and Systems

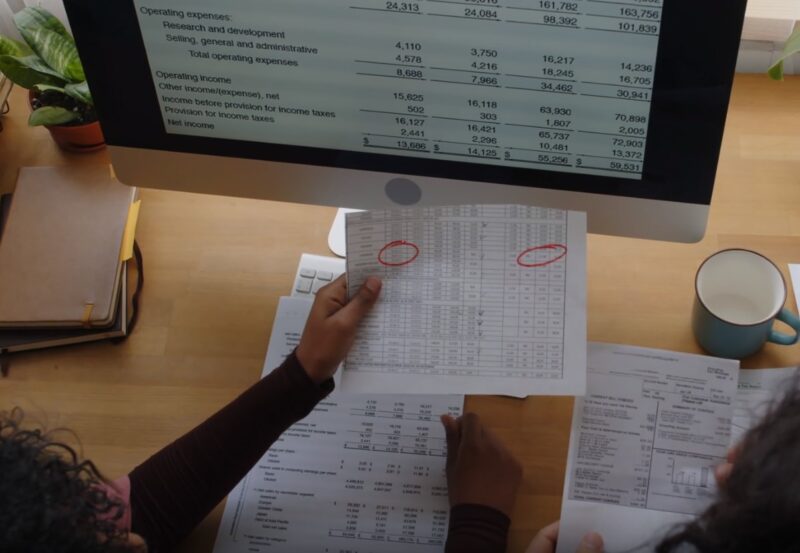

In today’s digital age, payroll administration is heavily reliant on technology, with sophisticated software solutions streamlining payroll processes and enhancing efficiency. Training programs offer hands-on experience with payroll software and systems, enabling participants to master essential functions such as payroll processing, tax calculations, time tracking, and reporting.

By becoming proficient in these tools, payroll professionals can streamline operations, minimize errors, and improve overall productivity. Through comprehensive training in both technological advancements and data protection measures, payroll professionals can ensure the integrity and confidentiality of payroll operations in today’s digital landscape.

Ensuring Accuracy and Precision

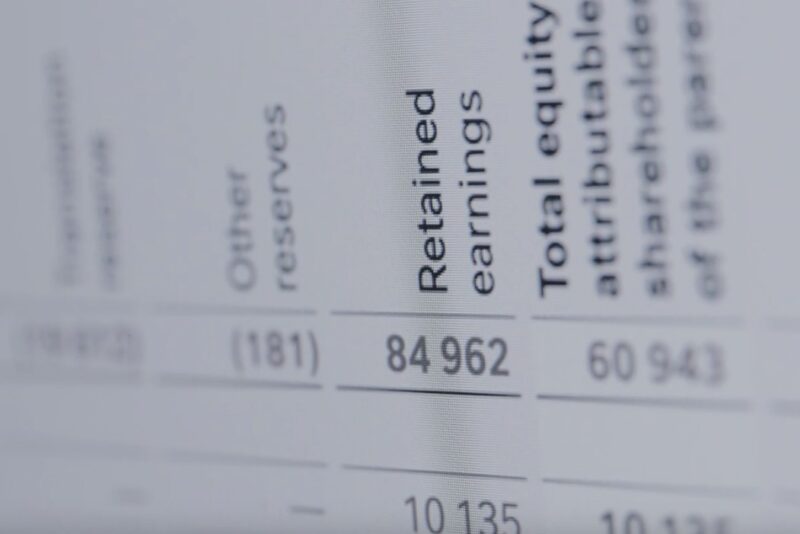

Accuracy is paramount in payroll administration, as even minor errors can have significant consequences for both employees and employers. Training programs emphasize the importance of precision in payroll processing, providing participants with the skills and techniques needed to perform calculations accurately, verify data integrity, and troubleshoot discrepancies effectively.

By instilling a commitment to accuracy, payroll administration training helps professionals minimize errors and maintain the integrity of payroll records. They also learn to stay vigilant for potential discrepancies or irregularities that may arise during the payroll process, enabling proactive resolution and compliance with auditing standards.

Through meticulous attention to detail and adherence to best practices in auditing, payroll administrators contribute to the overall financial health and regulatory compliance of their organizations.

Managing Employee Benefits and Deductions

Beyond basic wages and salaries, payroll administration also encompasses the management of employee benefits and deductions, including health insurance, retirement plans, and garnishments.

Training programs delve into the complexities of benefits administration, covering topics such as eligibility criteria, enrollment processes, contribution calculations, and compliance with regulatory requirements. Participants gain a comprehensive understanding of how to administer employee benefits effectively while ensuring compliance with applicable laws and regulations.

These training programs also emphasize the importance of effective communication with employees regarding their benefits packages, ensuring clarity and transparency in benefit offerings and enrollment processes. Through comprehensive training in benefits administration, payroll professionals can effectively support employee well-being and satisfaction while ensuring compliance with regulatory standards.

Enhancing Communication and Customer Service

Effective communication and exceptional customer service are essential components of successful payroll administration. Payroll professionals must be able to communicate clearly and effectively with employees regarding payroll-related inquiries, issues, and updates.

Training programs emphasize the importance of communication skills and customer service excellence, providing participants with strategies for addressing employee concerns, resolving conflicts, and delivering timely and accurate payroll information.

Training programs also cover conflict resolution techniques, empowering payroll professionals to navigate challenging situations with diplomacy and tact, ultimately enhancing employee satisfaction and morale. Through effective communication and exemplary customer service, payroll administrators play a pivotal role in fostering a positive workplace environment and promoting organizational success.

Preparing for Continuous Learning and Development

Payroll administration is a dynamic field that continues to evolve in response to changes in technology, regulations, and business practices. Training programs not only provide participants with foundational knowledge but also instill a commitment to lifelong learning and professional development.

By fostering a culture of continuous learning, payroll administration training ensures that professionals remain current with industry trends, expand their skill sets, and adapt to emerging challenges and opportunities.

These programs also emphasize the importance of staying proactive and forward-thinking in anticipating and addressing future challenges, empowering payroll administrators to drive innovation and contribute to organizational success. Through a dedication to lifelong learning and proactive adaptation, payroll professionals can navigate the dynamic nature of their field and remain valuable assets to their organizations.

Conclusion

Payroll administration training plays a pivotal role in building a solid foundation for professionals tasked with managing payroll functions within organizations. By imparting essential knowledge, skills, and competencies, training programs enable participants to navigate the complexities of payroll processing with confidence and accuracy.

Moreover, training instills a commitment to compliance, precision, communication, and continuous learning, ensuring that payroll professionals are well-equipped to meet the challenges of the ever-changing business landscape.

Furthermore, payroll administration training fosters a culture of collaboration and teamwork among professionals, encouraging the exchange of ideas and best practices to optimize payroll processes and drive organizational efficiency.